To avoid this, the universe of small and large capitalization stocks consisted of all securities in the Chicago Research in Security Prices (CRSP) dataset or S&P Compustat Database with an inflation-adjusted market capitalization of $200 million when they were selected each year. Returns could be artificially inflated if companies that went bankrupt were not included in the backtest. I assume this refers to the ratios and indicators they used to select quality microcap companies. However they did mention that the models constructed “ may have been designed with the benefit of hindsight”. These are experiences researchers so even though they did mention using information that would have been publicly available at the time of investing in a stock, I am sure they automatically did this.

Hey what about bias in the back test? Look-ahead bias At the moment they do not even have a Microcap fund. Since the paper appears to be for the benefit of individual investors, there does not seem to be any potential conflicts of interest. The researchers are all in-house analysts without any stated conflicts of interest.

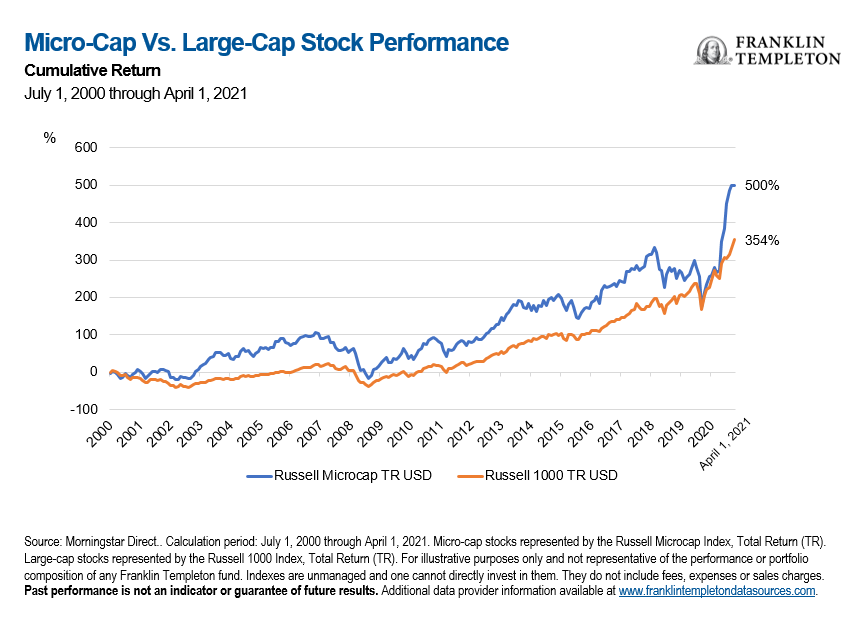

They did this research to show that high returns could be made from investing in microcap stocks. The seven researchers includes the CEO and six Chartered Financial Analysts (CFAs). The research was done by O'Shaughnessy Management, a quantitative investment management firm with around $6.2 billion of assets under management. Because they are so small, they are ignored by big investors and have little to no coverage by analysts.īefore we dive into the actual strategies and the returns, let me give you more information about the people behind the research. To find out how you can find the same investment ideas they came up with for your portfolio keep reading for detailed step by step instructions.Īs mentioned microcap companies are defined by O’Shaughnessy to be companies with a market value between $50 million to $200 million.

#What are micro cap stocks how to#

We show you exactly how to do it – step by step

#What are micro cap stocks professional#

0 kommentar(er)

0 kommentar(er)